When it comes to starting or expanding your business, finding the lowest interest rate for a business loan in the Philippines is crucial. A lower interest rate means less financial burden and more savings in the long run. It allows you to have more funds available for other business expenses or investments.

Business loans can help you finance various aspects of your business, whether it’s purchasing equipment, hiring more staff, or expanding your operations. However, it’s important to choose a loan with the lowest interest rate to ensure that you can manage your repayments effectively.

Factors affecting business loan interest rates

The interest rate on a loan determines how much you will pay back in addition to the original loan amount, so it is crucial to find the lowest interest rate possible. Here are some factors that can affect business loan interest rates:

1. Credit score: Your credit score is a measure of your creditworthiness and is an important factor that lenders consider when determining the interest rate for your business loan. A higher credit score indicates a lower risk for the lender, which can lead to a lower interest rate. It is important to maintain a good credit score by paying your bills on time and managing your finances responsibly.

2. Loan amount: The size of the loan you are requesting can also affect the interest rate. Generally, larger loan amounts may have lower interest rates, as lenders may be more willing to offer competitive rates for larger loans. However, this may vary depending on the lender and the specific terms of the loan.

3. Loan term: The length of the loan term can also impact the interest rate. Longer loan terms may have higher interest rates, as the risk for the lender increases over time. Shorter loan terms may come with lower interest rates, but the monthly payments may be higher. It is important to find a balance between the length of the loan term and the interest rate that works best for your business.

4. Collateral: Providing collateral can help to secure a lower interest rate. Collateral is an asset that you pledge as security for the loan, such as real estate or equipment. By offering collateral, you are providing the lender with a way to recover their money if you default on the loan. This reduces the risk for the lender, which can result in a lower interest rate.

5. Economic conditions: Economic conditions can also play a role in business loan interest rates. During times of economic uncertainty or recession, interest rates may be higher as lenders may perceive higher risk in lending to businesses. On the other hand, during times of economic growth, interest rates may be lower as lenders may perceive lower risk in lending to businesses.

6. Lender policies: Each lender may have their own policies and criteria for determining interest rates on business loans. It is important to research and compare different lenders to find the one that offers the most competitive interest rates for your business. This can involve factors such as the lender’s risk appetite, market conditions, and competition.

Types of business loans in the Philippines

When it comes to starting or expanding a business in the Philippines, there are several types of loans available to entrepreneurs. These loans can provide the necessary capital to fund a new venture, purchase equipment, or cover operational expenses. Here are some of the most common types of business loans offered in the Philippines:

1. Term Loans: Term loans are a popular choice for entrepreneurs looking to finance their business. These loans are typically offered by banks and financial institutions and have a fixed repayment term. The interest rates and repayment terms vary depending on the lending institution and the borrower’s creditworthiness.

2. Equipment Loans: As the name suggests, equipment loans are specifically designed to finance the purchase of equipment needed for the business. Whether it’s machinery, vehicles, or technology, equipment loans can provide the necessary funds to acquire the assets essential for business operations.

3. Working Capital Loans: Working capital loans are designed to provide businesses with the funds needed to cover day-to-day operational expenses, such as inventory purchase, payroll, and overhead costs. These loans help businesses maintain cash flow and ensure smooth operations.

4. Invoice Financing: Invoice financing is a type of loan where businesses can borrow money against their outstanding invoices. This type of financing can be particularly useful for businesses that experience cash flow gaps due to delayed customer payments.

5. Microloans: Microloans are small loans typically provided to micro-enterprises and small businesses. These loans have lower borrowing amounts and shorter repayment terms compared to traditional business loans. Microloans are often offered by microfinance institutions or government agencies to support local entrepreneurs.

6. SBA Loans: The Small Business Administration (SBA) in the Philippines offers loans to small and medium-sized enterprises (SMEs) to support their growth and expansion. These loans are backed by the government and are often available at lower interest rates compared to other business loans.

| Loan Type | Interest Rate Range |

| Term Loans | 5% – 15% |

| Equipment Financing | 8% – 20% |

| Working Capital Loans | 10% – 30% |

| Invoice Financing | 2% – 10% |

How to Find the Lowes Interest Rates for business loan in the Philippines

When looking for a business loan in the Philippines, finding the lowest interest rate is crucial to ensure that you can repay the loan without incurring excessive costs. Here are some steps you can take to find the lowest interest rate for business loans:

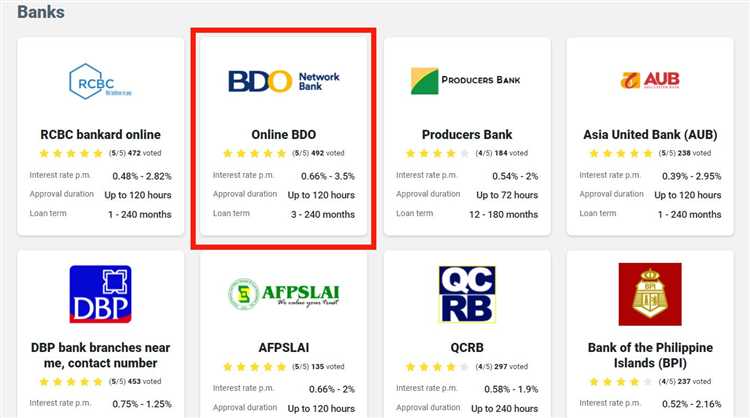

1. Research Different Lenders: Start by researching different lenders in the Philippines that offer business loans. Look for reputable lenders with a track record of providing favorable interest rates to borrowers.

2. Compare Interest Rates: Once you have identified potential lenders, compare the interest rates they offer. Take note of any additional fees or charges that may be applicable.

3. Check Requirements: Review the eligibility requirements to qualify for a business loan from each lender. Some lenders may have stricter requirements, while others may be more lenient. Consider your own financial situation and choose a lender that aligns with your needs.

4. Take Advantage of Promotions: Keep an eye out for any special promotions or offers that lenders may have. Some lenders may offer lower interest rates or reduced fees for a limited time. Take advantage of these promotions if they align with your borrowing needs.

5. Seek Recommendations: Reach out to other business owners in your network and ask for their recommendations. They may be able to provide insights into lenders that offer competitive interest rates for business loans.

6. Consult with Financial Advisors: If you are unsure about where to start, consider consulting with financial advisors. They can provide guidance and help you find the best loan options with the lowest interest rates.

Consider collateral and credit history

When applying for a business loan in the Philippines, financial institutions often consider collateral and credit history as important factors in determining the interest rate. Collateral refers to any asset that you pledge as security for the loan, which can include real estate properties, vehicles, or equipment.

If you have valuable collateral to offer, it can help you secure a lower interest rate as it reduces the lender’s risk. The lender can seize and sell the collateral in case of default, ensuring that they can recoup their investment.

Another crucial factor that lenders consider is your credit history. Your credit history reflects your past borrowing and repayment behavior. If you have a good credit score and a positive credit history, it demonstrates your ability to manage debt responsibly. Lenders are more likely to offer you a lower interest rate if you have a solid credit history.

On the other hand, having a poor credit history or no credit history can make it challenging to secure a business loan, and if you do, the interest rate may be higher.

| Factors to consider: | Explanation: |

| Collateral | Assets pledged as security for the loan |

| Credit history | Past borrowing and repayment behavior |

Negotiate with lenders

When looking for the lowest interest rates for business loans in the Philippines, it’s important to remember that these rates are not fixed. As a borrower, you have the right to negotiate with lenders to get the best possible deal. Here are a few tips on how to effectively negotiate with lenders:

1. Do your research: Before entering into negotiations, make sure you have a good understanding of the current interest rates and terms offered by different lenders in the market. This will give you a baseline to work with and help you determine what is a fair and competitive offer.

2. Highlight your creditworthiness: Lenders will be more inclined to offer you a lower interest rate if you can demonstrate that you are a low-risk borrower. Provide them with your financial statements, credit history, and any other relevant documents that showcase your creditworthiness.

3. Compare offers: Don’t settle for the first offer you receive. Shop around and compare offers from different lenders. Use this information to your advantage during negotiations by leveraging the offers against each other.

4. Negotiate the terms: In addition to the interest rate, be sure to negotiate other terms of the loan, such as the repayment period, any fees or charges, and any collateral requirements. Sometimes, lenders may be willing to lower the interest rate if you agree to a longer repayment period or provide additional collateral.

Нow to get the lowest interest rate for business loan in the Philippines

If you want to improve the interest rate for your business loan, there are several strategies you can consider:

- Build a strong credit history: Make timely payments on all your existing debts and keep your credit utilization low. Avoid taking on excessive debt or defaulting on any loans.

- Offer valuable collateral: If possible, provide valuable assets as collateral to assure lenders that they have a means of recovering their funds.

- Seek a co-signer or guarantor: Having a co-signer or a guarantor with a strong credit history can improve your chances of securing a lower interest rate.

- Shop around for the best loan options: Different lenders may offer different interest rates based on their evaluation criteria. Take the time to compare loan terms and rates from various lenders to secure the most favorable option.

In conclusion

Finding the lowest interest rate for business loans in the Philippines requires research, comparison, and understanding of the factors that affect interest rates. By taking the time to explore your options and make an informed decision, you can find a loan with a low interest rate that meets your business’s financial needs and enables growth and success.

What are the current interest rates for business loans in the Philippines?

The interest rates for business loans in the Philippines vary depending on the lender and the type of loan. However, as of now, the average interest rates range from 5% to 15%. It’s important to note that these rates can change, so it’s always best to check with different lenders to find the lowest rate available.

What factors affect the interest rates for business loans in the Philippines?

There are several factors that can affect the interest rates for business loans in the Philippines. These include the borrower’s credit history, the loan amount, the loan term, the type of business, and the lender’s policies. Generally, borrowers with a good credit history, a lower loan amount, and a shorter loan term are more likely to get a lower interest rate.

Are there any government programs that offer low-interest business loans in the Philippines?

Yes, there are government programs in the Philippines that offer low-interest business loans. One example is the Small Business Corporation (SB Corporation), which provides financing programs for micro, small, and medium enterprises (MSMEs) at competitive interest rates. The Development Bank of the Philippines (DBP) also offers business loans with favorable interest rates and flexible repayment terms. It’s recommended to research and inquire about these government programs to see if you qualify for their low-interest loan options.

Leave a Reply